This rate is almost always higher than the long-term capital gains tax rate of 15 or 20 for very high-income earners if you held the shares for more than one year before selling. Often brokerage commissions and fees for buy and sell orders.

Roth Ira Contribution Limits For 2021 Kiplinger

You are at least 59 and a half years old and.

How often can i buy and sell stocks in a roth ira. You wont have to pay capital gains taxes if you buy your favorite companys stock and sell it six months later. To put it another way you can sell stocks in your Roth IRA whenever you choose and not have to disclose the profits on your tax return. Roth IRA 5-Year Rule In general you can withdraw your earnings without paying taxes or penalties if.

Its been at least five years since you first contributed to any Roth IRA the five-year rule. Visit The Official Edward Jones Site. Doing so means that you can also take any proceeds you make from your IRA investments and reinvest them in stocks you choose.

This tax-free safety net also applies to stock purchases and sales in your Roth IRA. You can hold nearly any financial asset including CDs bank accounts mutual funds ETFs stocks bonds and cash alternatives like money market mutual funds within a Roth IRA. The IRS prohibitions on IRA investments are limited to a list of transactions such as borrowing money from your IRA using it as collateral or selling.

Yes you can trade actively in a Roth IRA. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. In fact its.

Buying and selling within a Roth IRA amounts to a tax bonanza for account holders as neither income nor capital gains are ever taxed. Roth IRA Stocks Mutual Funds. Within an IRA you invest in stocks.

You typically will not pay tax on Roth withdrawals including earnings generated by stocks if you wait until you turn 59 12 and have held your Roth account for at least five years before accessing your cash. The result of the free riding rule is that you cannot effectively trade short-term less than three-day holding period in an IRA account. 401k and IRA Tips and Answers.

Buy Sell and Trade Stocks. If you intend to sell and buy stocks frequently doing it inside an IRA offers tax advantages. You can buy and sell stocks for capital gains and.

In a cash account like a Roth IRA you have to wait for a transaction to settle and that takes a couple days. To put it another way you can sell stocks in your Roth IRA whenever you choose and not have to disclose the profits on your tax return. Buying and selling stocks in the Roth IRA has no tax impact at all.

Refer to Internal Revenue Service Publication 590 to view exceptions to this rule of thumb. Learn more in our guide. If you are over 59-12 and the Roth has been opened at least 5 years you can withdraw money from a Roth with no taxes or penalties.

Individual Retirement Accounts A traditional IRA lets you deduct your contributions and defers taxes on all your IRA. New Look At Your Financial Strategy. Withdrawals will also be tax-free.

According to this rule unless your trading is restricted to a small amount of your overall balance you are most likely to receive a good faith warning. You can buy sell and re-buy stocks in your IRA as frequently as you like. Tax benefits and consequences for most stocks in IRAs If you buy or sell shares of a C corporation inside an IRA you wont pay any taxes.

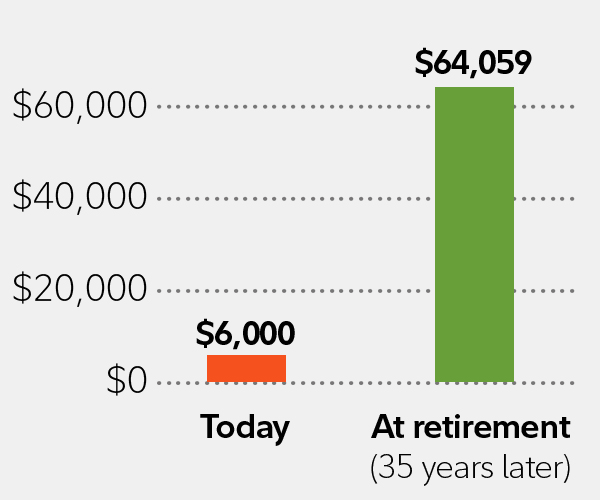

This guide may be especially helpful for those with over 500K portfolios. In the meantime youre unable. You invest in a Roth with after-tax dollars that can then grow and compound free of tax.

It usually takes at least 1 business day but often several business days for your Dec 06 2021 Can you withdraw buying power robinhood. If you remove your earnings before youre eligible youll be penalized. Or any other securitiesthat are made within an individual retirement account are not taxable.

You wont have to pay capital gains taxes if you buy your favorite companys stock and sell it six months later. Can you buy and sell stocks in an IRA tax free. Can I Buy and Sell Stocks in My Roth IRA.

A spectacular profit on a stock youve owned just a little while gets taxed at the short-term. Incoming stock transfers are free while outgoing transfers cost per transaction. You can invest in index funds through a Roth IRA but that is not the only means to access such funds.

13 hours agoAfter placing the sell order robinhood will ask you to transfer the money from your account by bank wire or ach transfer. The most important regulation governing Roth IRA investments in stocks is the 3-day trade settlement rule. Almost any type of investment is permissible inside an IRA including stocks bonds mutual funds annuities unit investment trusts UITs exchange-traded funds ETFs and even real estate.

You can buy sell and re-buy stocks in your IRA as frequently as you like. Can you buy index funds in a Roth IRA. So if you are trading on a regular basis keep your trades at least 3 days apart.

Roth IRA Assets For example you can buy 100 shares of stock in your Roth IRA and later sell it for a profit and the capital gain from that transaction will not be taxed. Using a Self-Directed IRA LLC affords the IRA holder a considerable amount of freedom when it comes to making IRS-approved investments whether traditional or alternative. Ad Roth IRAs can have tax benefits.

You wont pay taxes on these proceeds by doing so as long as. Can you buy and sell stocks in an IRA. Taking money out of the IRA is the only time it has tax impact no matter what internal transactions generated the money.

Stocks in IRAs If you can buy or sell a stock in a regular account you can also buy or sell it in your IRA. Once your brokerage account is all set up you can then buy sell and hold stocks within your Self-Directed IRA.

How To Invest Your Ira Fidelity

No comments